One of the most common questions that is currently asked by clients is what the prospects are for commercial property in the future. We have all by now – in our new normal world - got used to meeting our dearest friends, family, and work colleagues on Zoom or Skype, working from home, and shopping online. High streets and shopping malls were struggling even before the events of 2020 with Debenhams and several middle-market food chains in trouble.

That has led some investors to beg the question as to what the future holds for commercial property. Will everyone work from home? Will companies reduce their office space needs, providing workers with a hot desk each morning, if they are in? Will retail companies go into administration to put pressure on landlords to reduce rents? Will more people shop online? The answer to all of these questions is probably ‘yes’. Does that mean that we should abandon a well-diversified, liquid exposure to global commercial property accessed via real estate investment trusts (REITs), which are listed property companies, focused almost exclusively on generating rental income? We think not.

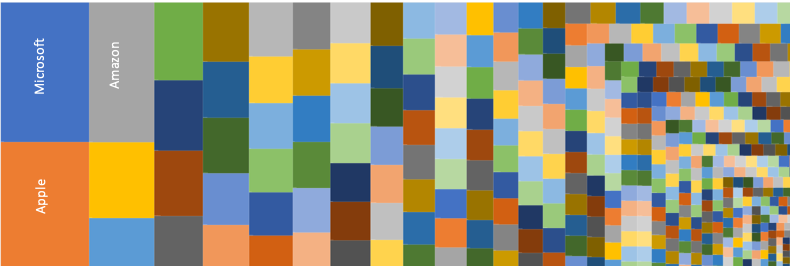

First, let us look at the flipside of the changes that are occurring. To be sure, some sectors may struggle. But for every Debenhams, there will be a company moving into, or even starting up, online, which will require logistics centers and warehousing. In our digital age, there is increasing demand for secure and up-to-date data centers, improved and more numerous healthcare facilities for example. You can see from the chart below that the global commercial property REITs cover many things.

In a globally diversified REIT index fund, there are over 350 individual REITs (listed property companies) each of which is comparable to a property fund in its own right. It is estimated that such a fund contains around 90,000 properties[1] spread across property types, global markets, and strategies.

Second, let us spend a moment thinking about markets. These worries about the retail sector, for example, have been around for some time and you will not be the only person thinking about these issues. In fact, thousands - or even millions – of people will already have done so and acted on their view of the future of property, by buying and selling these REITs in the market. The aggregate view will be reflected in today’s REIT prices: all the doom, gloom and uncertainty is priced into the process of REITs already; all the likelihood that the way we work changes is priced in already; and all the good news about data centers and warehousing is priced in already. So, the future prospects for commercial property will depend on what happens relative to this expectation. It may be better or worse, depending on information we do not yet know. The release of that information is random. What we do know is that commercial property will continue to be needed and that companies will have to pay rent. We would not abandon owning a diversified equity portfolio because some sectors are struggling (airlines and energy) or concentrate our portfolio in sectors that are booming (technology). It is already in the price. Companies and sectors wax and wane.

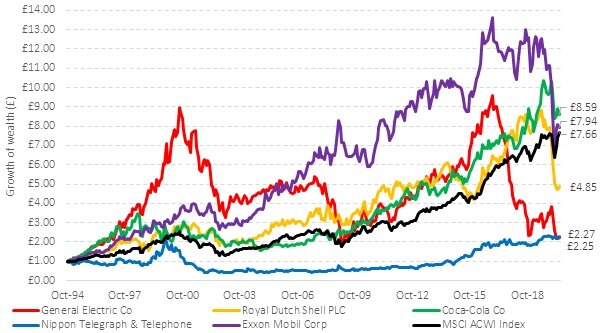

Third, let us think about why we hold it in portfolios in the first place. Property tends to have a different return experience to equities (even though property companies are listed on stock markets). At specific times, and across time, this can provide diversification to a portfolio. In addition, over time property has provided protection from inflation; after all, a property is a property and many rental agreements are linked to some measure of inflation. With the rapid increase in the money supply, on account of all the government support packages around the world, higher inflation - not something most feel the need to worry about currently – is one future scenario. Cover the bases - but all things in moderation - is a sensible approach. An allocation to global commercial property still makes sense for long-term investors, as part of their diversified growth assets.

[1] Source: Prologis is the largest REIT at 5% of the index and owns ~4,500 properties. Scaling this up implies around 90,000 properties across the index, as a rough proxy.

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.