Globally, the most significant upcoming election is in the US, but of course, the UK election is also expected towards the end of this year.

There are similarities to US and UK politics in that it is generally a race between two parties, as the charts below show:

There appears to be greater party loyalty in the US despite how voters may feel about the leader. In all elections, the person who wins is often decided by a minority of people, the swing voters. Between 1952 and 1980, this was 12% of the electorate, and now it is thought to be around 3%.

In the UK, “swing voters” tend to revolve around age groups, and therefore, where US elections tend to be very tight, UK elections can see large majorities. Thatcher (1983 – 144 majority), Blair (1997 – 178 majority) and Johnson (2019 – 81 majority).

The question is, from a stock market perspective, does it matter who wins an election?

US Data

Two separate pieces of data indicate that annual US growth is better under a Democratic President.

The Economic Policy Institute (EPI) is a respected non-profit, non-partisan think tank. Due to its work, which is aimed at low—and middle-income families, some view it as more left-leaning.

The second piece of research is from the Joint Economic Committee, which is responsible for reporting the current economic condition of the United States and for making suggestions for improvement to the economy. This also indicates that growth is stronger under a Democratic President:

According to CNN data, the US stock market has performed better under the Democrats since 1945.

However, there isn't much difference if you consider data over a more extended period. Deutsche Bank provided this chart.

The key takeaway is that the data seems to suggest that the Democratic Party are better for the economy and markets. However, as we can see in the chart above, the actual returns have been broadly similar in recent years.

UK Data

Similar research is complicated to ascertain in the UK. However, this data from the Office for National Statistics from 1955 (Q1) to 2019 (Q2) shows annualised Gross Domestic Product (GDP). The theory is that the higher the rate, the more the economy will grow. This slightly favours a Conservative Government.

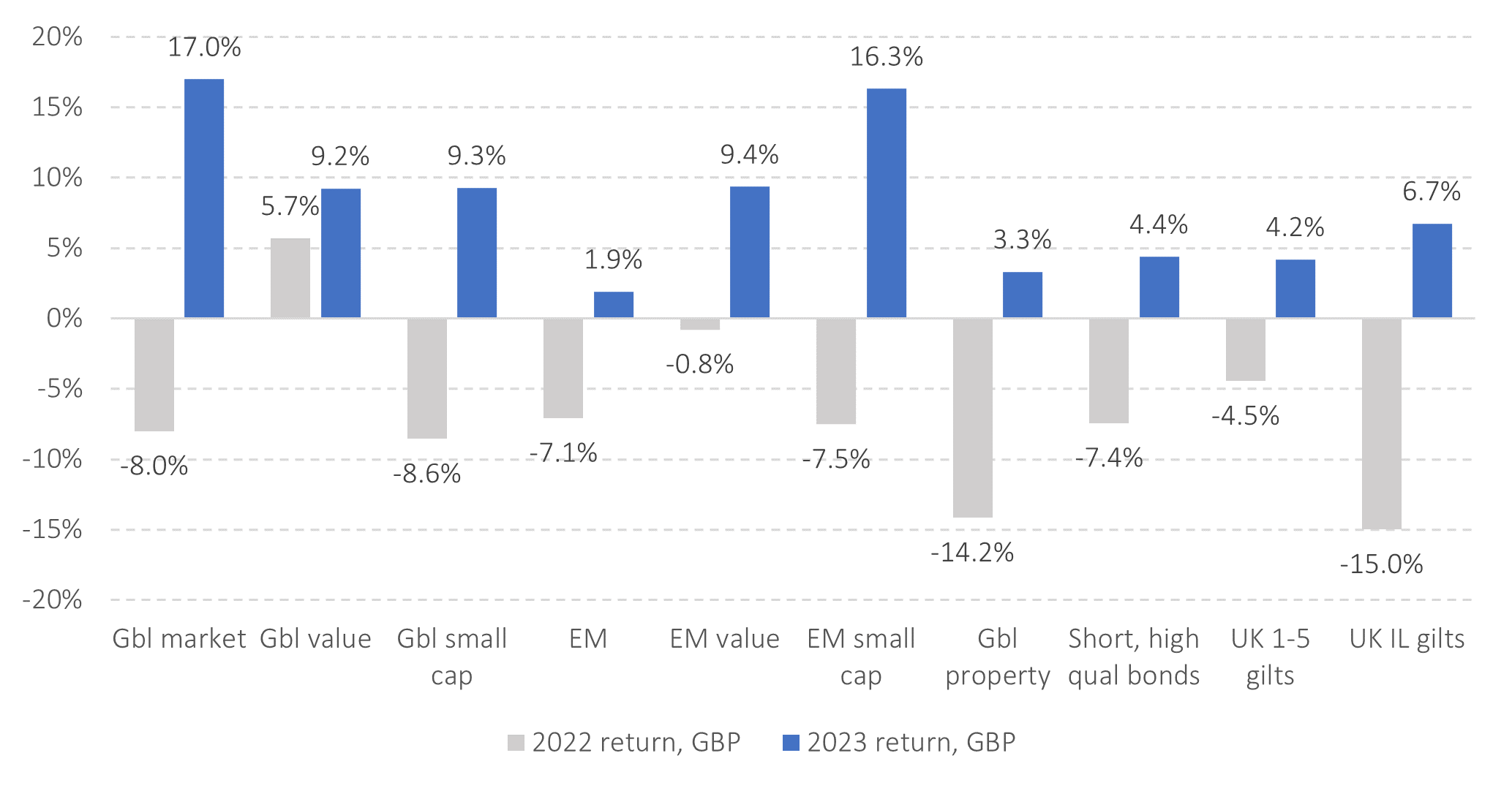

The chart below is more relevant as it shows stock market returns.

However, this is hard to Judge as Labour from 1997 saw five financial shocks (Asian Financial Crisis, Russian Financial Crisis, Dot-com bubble bursts, September 11, and Global Financial Crisis) compared to the Conservatives from 2010 (Brexit referendum, Covid Pandemic, and Inflation).

To conclude

We cannot predict the outcome of the elections or what any new Government may or may not do. Evidence indicates that whichever party comes to power in the US and the UK makes little difference to long term stock market performance.

Stock markets and currency markets can be volatile before and after an election, but over the long term, they will adapt to the regime in power and the state of the economy. Events outside the government's control are often more likely to impact markets.

There are perhaps three things to consider irrespective of the elections:

Equity valuations globally (excluding the US) remain at or below their long-term averages, meaning there are long-term opportunities for returns within diversified portfolios.

The Inheritance Tax Band was set at £325,000 in 2009/10; this hasn’t changed at a time when house prices and other assets have.

Allowances for capital gains and dividends have come down, meaning more investors are paying taxes.

In conclusion, we will not position (or reposition) our investment strategy based on any upcoming elections. We maintain our long-term strategies and adapt to any new legislation and tax allowances.

General disclaimer: The data has been sourced from external sources. Although we have looked to ensure this is as accurate as possible, we are not responsible. The blog is written personally and reflects the author's view; it does not necessarily reflect the opinions of Ifamax Wealth Management. Individuals wishing to buy any product or service because of this blog must seek advice or conduct their research before making any decision. The author will not be liable for decisions made because of this blog (particularly where no advice has been sought). Investors should note that past performance does not guide future performance, and investments can fall and rise.