Mitigating an unknown future

One of the hardest concepts to grasp in investing is that a ‘good’ company is not always a better investment opportunity than a ‘bad’ company. If we believe that markets work pretty well – not unreasonable given that few investment professionals beat the market over time - and that they incorporate all public information into prices pretty quickly and efficiently, all of the ‘good’ and ‘bad’ news should already be reflected in these prices. A ‘good’ company will have to do better than the aggregate expectation set by the market for its share price to rise and vice versa. If a ‘bad’ company is in fact a less healthy company, it may have a higher expected long-term return, as risk and return are related.

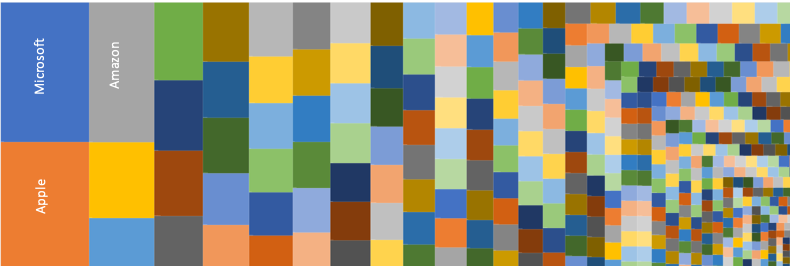

It is perhaps evident that if the market incorporates the aggregate forward-looking views of all investors, it becomes very difficult to choose which companies, sectors, and geographic markets are likely to do best, going forward. In an uncertain world, where stock prices could move rapidly, and with magnitude, on the release of new information - which is itself a random process – then it makes good sense to ensure that an investment portfolio remains well diversified across companies, sectors and geographies. Take a look at the chart below that illustrates how deeply diversified a globally equity portfolio can be.

Figure 1: If you do not know which stocks are going to outperform well, own them all

Source: Albion Strategic Consulting. Data: Morningstar Direct © 2020. All rights reserved.

The concentration risk in the US’s S&P500, is quite different.

Figure 2: The US’s S&P500 is increasingly concentrated in a few names.

Source: Albion Strategic Consulting. Data: Morningstar Direct © 2020. All rights reserved.

Given that all the future promise of a company is already reflected in its price today, it is quite a risk betting a large part of your assets on just a few names, concentrated, for example, in the technology sector. The top 8 technology stocks in the US now have a larger market capitalisation than every other non-US market except for Japan. Dominance of companies, sectors and markets ebb and flow over time. Who is the next Amazon? What regulatory pressures could these dominant companies face? Is Donald Trump’s recent rage against Twitter the start? No-one knows. By remaining diversified, you will own the next wave of market leaders as they emerge and dilute the impact of ebbing companies. Whilst it is always tempting to look back with the benefit of our hindsight goggles and wish we had owned more (take your pick), US tech stocks, other growth stocks, gold etc., what matters is what is in front of us, not what is behind us.

‘The safest port in a sea of uncertainty is diversification.’

Larry E. Swedroe, Investment Author

Risk Warning This newsletter does not constitute financial advice. Remember that your circumstances could change and you may have to cash in your investment when the value is low. The value of your investment and any income from it can go down as well as up and you may not get back the original amount invested. Past performance is not necessarily a guide to the future. If you are in any doubt you should seek financial advice.