Over the long run, the market has provided substantial returns regardless of who lives at Number 10.

Next month’s snap election is the first national vote in the UK since the EU referendum. While the election’s outcome and overall impact are unknown, there is no shortage of speculation about how the election will impact the stock market. Below, we explain why investors would be well-served avoiding the temptation to make significant changes to a long-term investment plan based upon these sorts of predictions.

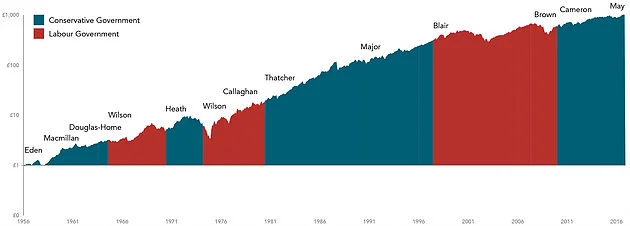

Exhibit 1: Growth of a Pound Invested in the Dimensional UK Market Index

January 1956–December 2016

For illustrative purposes only. Past performance is not a guarantee of future results. Index is not available for direct investment, therefore, their performance does not reflect the expenses associated with the management of an actual fund. Dimensional indices use CRSP and Compustat data.

Trying to outguess the market is often a losing game. Current market prices offer an up-to-the-minute snapshot of the aggregate expectations of market participants— including expectations about the outcome and impact of elections. While unanticipated future events (genuine surprises) may trigger price changes in the future, the nature of these events cannot be known by investors today. As a result, it is difficult, if not impossible, to systematically benefit from trying to identify mispriced securities. So it is unlikely that investors can gain an edge by attempting to predict what will happen to the stock market after a general election.

The focus of this election is Britain’s exit from the EU. But, as is often the case, predictions about the outcome and its effect on the stock market focus on which party will be “better for the market” over the long run. Exhibit 1 shows the growth of £ 1 invested in the UK market over more than 60 years and 12 prime ministers (from Anthony Eden to Theresa May).

This exhibit does not suggest an obvious pattern of long-term stock market performance based upon which party has the majority in the Commons. What it shows is that in the long run, the market has provided substantial returns regardless of who lives at Number 10.

Equity markets can help investors grow their assets, but investing is a long-term endeavour. Trying to make investment decisions based upon the outcome of elections is unlikely to result in reliable excess returns for investors. At best, any positive outcome based on such a strategy will likely result from random luck. At worst, such a strategy can lead to costly mistakes. Accordingly, there is a strong case for investors to rely on patience and portfolio structure, rather than trying to outguess the market, in order to pursue investment returns.

Risk Warning

This newsletter does not constitute financial advice. Remember that your circumstances could change and you may have to cash in your investment when the value is low. The value of your investment and any income from it can go down as well as up and you may not get back the original amount invested. Past performance is not necessarily a guide to the future. If you are in any doubt you should seek financial advice.

Max Tennant - May 2017

Check out more of the latest news from IFAMax:

Pay less attention to weather forecasts