The Crowding Out Effect and the Importance of Value-Based Investing

Dear Investors,

This edition delves into the crowding-out effect within stock indexes and highlights the significance of adopting a value-based investment approach.

The crowding-out effect is when certain stocks dominate an index, potentially reducing diversification and investment opportunities. Simply put, you have little room for growth once you dominate your market. This point seems obvious when you think about it. Amazon, Google, and Apple, to name three. This effect can have several implications for investors:

Concentration Risk: When a few stocks within an index experience substantial price increases or attract a large portion of investor capital, they can dominate the index's market capitalization. This concentration can lead to concentration risk, making the performance of the entire index heavily dependent on these few stocks. As a result, the benefits of diversification may diminish.

Limited Investment Opportunities: The crowding-out effect can cause investors to flock to popular stocks, neglecting or overlooking other stocks within the index. This scenario limits investment opportunities as capital flows towards popular choices. Consequently, the overall breadth and depth of the index suffer, potentially impacting returns.

Market Distortions: When investors excessively concentrate on specific stocks, their prices inflate beyond their fundamental value. This overvaluation can create market distortions, as prices no longer accurately reflect underlying fundamentals. Consequently, when sentiment towards these crowded stocks changes, a correction or market downturn may occur, affecting the entire index.

Investors often turn to a value-based investment approach to navigate the potential downsides of the crowding-out effect. Here's where the value-based approach comes into play:

Emphasis on Intrinsic Value: Value-based investing identifies undervalued stocks relative to their intrinsic value. By analyzing a company's fundamentals and assessing its true worth, investors can uncover opportunities the market may have overlooked due to the crowding-out effect.

Diversification and Risk Management: A value-based approach promotes diversification across stocks considered undervalued. By spreading investments across various sectors and companies, investors can reduce concentration risk and limit potential negative impacts caused by the crowding-out effect.

Long-Term Focus: Value-based investing typically takes a long-term perspective, looking for opportunities that may provide sustainable returns over time. By focusing on the underlying value of a company and its growth potential, investors can withstand short-term market fluctuations caused by the crowding-out effect.

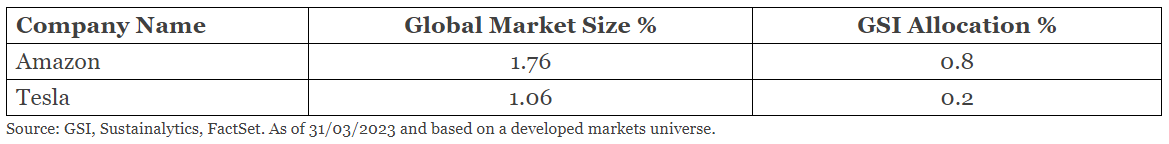

The fund that we use for investing in Global Developed Markets is the GSI Sustainable value fund. As an example of their strategy with two stocks in the S&P500, which one may consider are stocks that are crowding out the others:

Another interesting point is that, given time, approximately 1 in 35 listed companies will end up crowding out the other stocks at some point in future. How do we know which ones they will be? We don't, so allocating a little extra across all the cheap ones is best. Cheap. That can be measured—future dominance we cannot.

In conclusion, the crowding-out effect within stock indexes can pose challenges for investors, including concentration risk, limited investment opportunities, and market distortions. However, by adopting a value-based investment approach that emphasizes intrinsic value, diversification, and long-term focus, investors can mitigate these challenges and identify opportunities that may have been overlooked.