An upside-down view of currencies and interest rates

It has been a very tough first week for the chancellor, in his new job; lambasted by the media, accused by the Labour leader of ‘crashing’ the pound and causing higher inflation and interest rates; and a bad report from the IMF. It is certainly true that Sterling has been falling, and inflation and interest rates rising; yet to suggest that this is solely down to recent Government incompetence is to take a very narrow view. Putting hyperbole, politics and the minute-by-minute gyrations of the market aside for a moment, let’s take a step back and look at what has been going on.

Sterling’s woes or Dollar strength?

Sterling has been falling against the US dollar for some time, but turning this upside down, the dollar has been strengthening against Sterling. In fact, due to its status as a ‘safe-haven’ currency, and the Fed’s more aggressive rate raising strategy, which has resulted in more attractive shorter-term yields, the US dollar has strengthened against most major currencies over the past year, attracting global capital. It is also a major energy exporter, which adds extra support. The DXY index that tracks the dollar against six major currencies stands today at a 20-year high. As the chart below illustrates, Sterling is largely unchanged against the Euro and the Japanese Yen over the past year.

Figure 1: Dollar strength is the key driver of currency ‘weakness’ – 1 year to 27-Sep-2022

Data: Google.

A consequence of the weak Pound is importing inflation, as around one third of household consumption is made up of imports, which are now more costly.

Narratives that suggest that Sterling is turning into an emerging market currency and that this could lead to a currency crisis are headline grabbing but flawed. The UK has a flexible exchange rate (it is not pegged to any other currency); its financial markets are highly established and liquid; the Bank of England operates independently of the Government; and unlike emerging economies, almost the entirety of its debt is denominated in Sterling (1).

From an investor’s perspective, a rising US dollar provides a positive contribution to Sterling-based returns, as US assets are worth more – over 20% more - in the past year. This has helped to shore up portfolio returns for many. The UK equity market is down only around 3% in the past year (2), supported by large holdings to sectors such as energy and low holdings to technology, combined with the fact that a majority of earnings are from overseas, benefitting to some degree from these exchange rate movements. No-one really knows where Sterling will go from here and over what timeframe. Hedging fixed income assets remains sensible as this reduces their volatility and remaining unhedged (i.e. exposed to currency movements) in equity assets continues to make good sense and will support portfolio values if Sterling falls further.

Inflation and interest rate rises

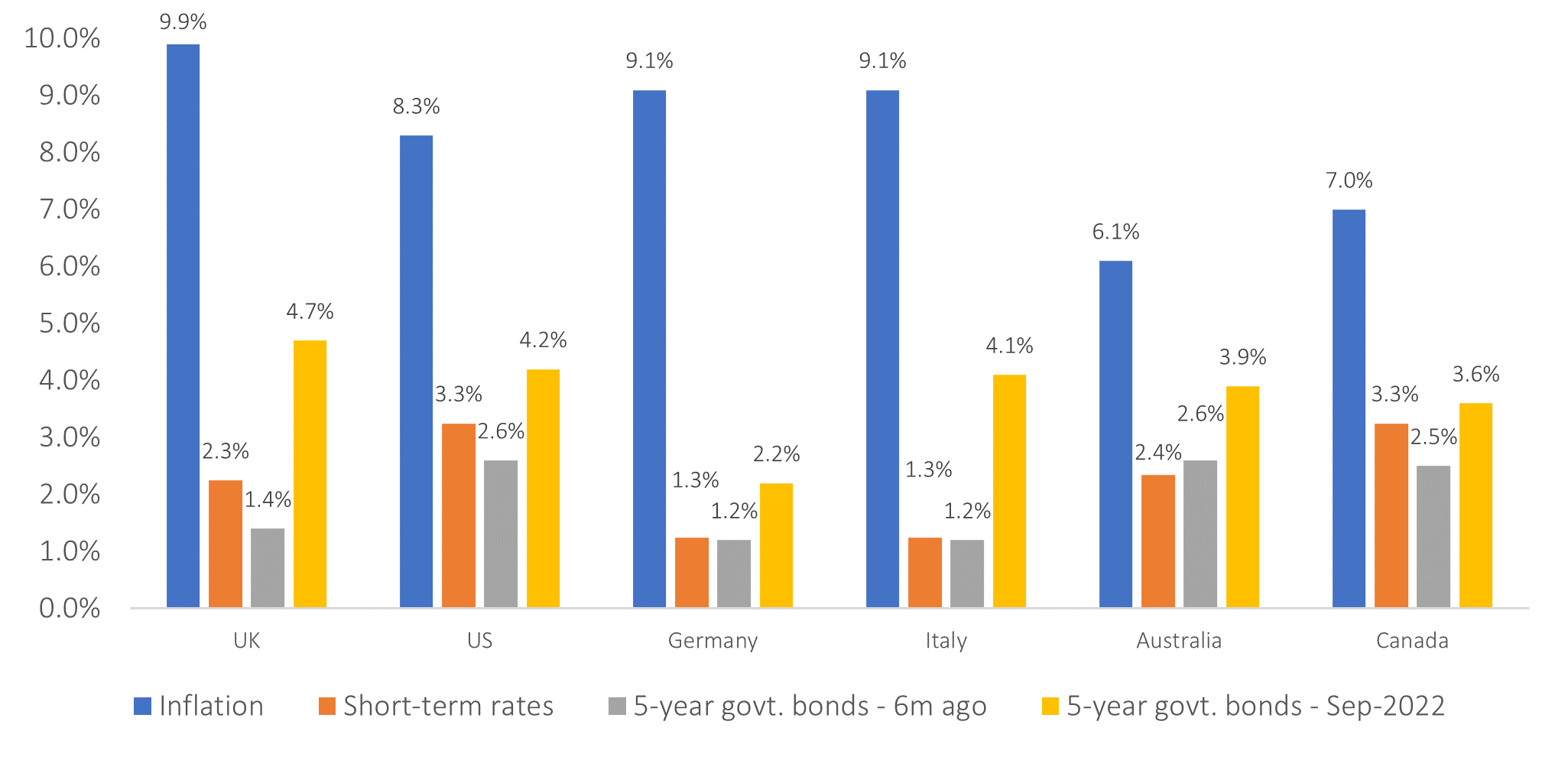

Again, reading the news one might get the impression that rising inflation and interest rates in the UK is a pain inflicted on the population entirely by its Government. Yet to turn this inward looking view outward, rising interest rates are a global phenomenon as the countries grapple with high inflation caused by a rapid growth in the money supply (quantitative easing), supply side issues caused by Covid, and the price pressures on energy and food created by Russia’s war in Ukraine. The fact that the UK Government needs to borrow more, as a consequence of the energy cost support packages and its unfunded tax cuts, is also contributing to rising yields. But take a look at inflation, central bank interest rates, and bond yields in a number of major economies in the chart below.

Figure 2: Inflation and interest rates on 27th September 2022

Data source: Countries’ central banks (note inflation for Germany and Italy is the Eurozone inflation rate).

It is evident that inflation is universally high. Five-year bond yields are at or near 4% in all but one of these economies, and all have risen materially in the past six months. Whilst that is bad news for mortgage and other borrowers, who have benefited from an extremely low cost of borrowing for many years, it is better news for those holding cash or investing in bonds. Despite bond price falls as a consequence of yield rises, long-term investors will be better off, over time (3), from yields at 4% than at near 0%, which we saw 18 months ago. In the UK real (after inflation) yields on index linked gilts are now in positive territory for the first time since 2010. That is good news for investors. As a consequence, investors’ future liabilities are likely to be more easily funded by their assets.

A few commentators have even begun to question whether the UK will be able to service its debts in the future, grabbing headlines. Yet, the UK still remains a major global economy and while the debt service burden will be increasingly heavy, it issues bonds in its own currency, can print money to pay its debts (in-extremis) and has a maturity profile with around half of its bonds maturing beyond 2030 – far longer than most major economies - reducing the short-term refinancing risks that often accompany defaults. Insurance against UK government debt default over five years implies the risk of default is negligible at less than 0.5% (4).

There is a school of thought, including that of the Chancellor, that the recent support for the supply side of the economy (i.e. increasing productivity and output) by incenting companies and entrepreneurs through tax reductions, may lead to higher rates of sustainable growth in the future, which will, in turn, help to reduce inflation and allow the Government to bring down debt. Obviously, this would take time. The markets currently seem unconvinced. In essence, no-one knows how this all plays out exactly. There is no doubt that there will be uncertainty ahead, but investors who own globally diversified portfolios of equities and higher-quality shorter-dated bonds are well-positioned to weather any possible storms.

The view from a bat’s perch, as we have seen, can provide useful perspective in a world full of politicians, central banks, economists, pundits and active investors all bumping around in the dark.

‘This too shall pass!’, as the late, great John C. Bogle used to constantly remind investors.

(1) See: https://www.economist.com/britain/2022/09/26/the-pound-is-plumbing-near-historical-depths-why

(2) Based on Vanguard FTSE U.K. All Share Index Unit Trust GBP Acc (GB00B3X7QG63:GBP) – for illustration purposes only. This is not a recommendation.

(3) Related to the duration of their bond holdings.

(4) 5-year credit default swap rates – from http://www.worldgovernmentbonds.com/country/united-kingdom/